International Social Projects

Working on the development of the people who need it most

82 social projects

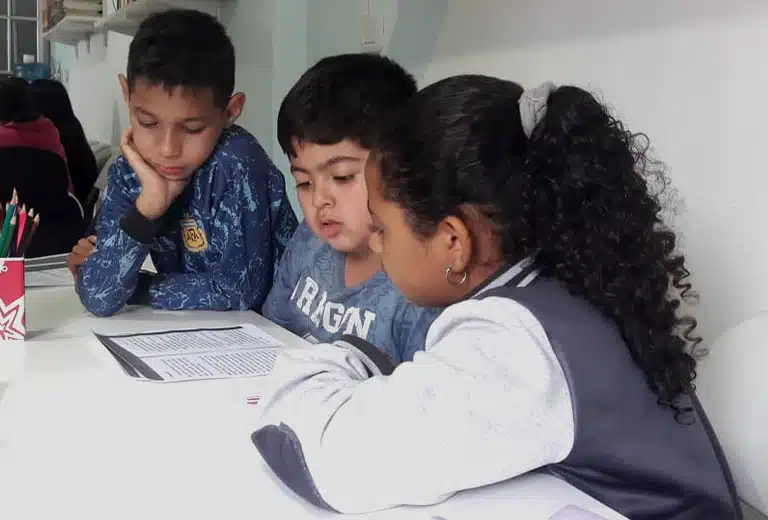

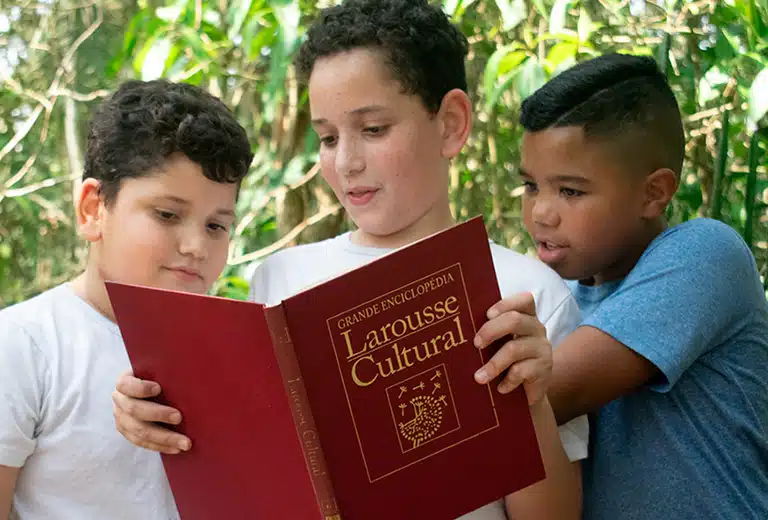

A society with a future is one that favors the development of the population. Our objective is to promote comprehensive education, mainly of children and young people coming from disadvantaged communities.

At Fundación MAPFRE we regard comprehensive education as one of all those needs which are critical for a person to be able to grow and develop fully. For that reason, we work in collaboration with social entities and local organizations on projects supporting education and nutrition.

Every year, our support is aimed at where we are most needed.

88.668

IMPROVED THEIR EDUCATION

71.142

RECEIVED NUTRITIONAL SUPPORT

67.410

ACCESSED TO MEDICAL TREATMENT

Know our projects

Pais

All

Argentina

Brasil

Brazil

Brazil_Brasil

Chile

Colombia

Costa Rica

Dominican Republic

Ecuador

El Salvador

Germany

Guatemala

Honduras

Italy

Italy_Italia

Malta

Mexico

Nicaragua

Panama

Paraguay

Peru

Philippines

Portugal

Puerto Rico

Turkey

United States

Uruguay

Venezuela

Vigencia

All

Completed Project

Current Project

156 projects

Displaying:

Fundación Carvajal boosts education in Colombia

Current Project

FUNDACOES breaks the cycle of child poverty in Honduras

Current Project

CEAP transforms lives through education in Brazil

Current Project

Fundación Uniendo Caminos offers school support to children, young people, and adults in Buenos Aires

Current Project

CIEDS provides opportunities for socially vulnerable neurodivergent children in Brazil

Current Project

A safe haven for children affected by violence

Completed Project

Comprehensive care for vulnerable families in La Guaira – Venezuela

Current Project

Vivendo Educação Project for Vulnerable Children in São Paulo

Current Project

School service at GRAACC Hospital

Current Project

Fundación Pérez Scremini offers educational support for hospitalized children in Uruguay

Current Project

A home for 54 children in Mar del Plata, Argentina

Completed Project

ASD de Patos offers educational support in Brazil and works to strengthen children and young people’s rights

Current Project